Walmart’s Cost Leadership Strategy: Optimizing Profit Through Efficiency and Scale

Walmart’s cost leadership strategy is built around a simple goal: run the retail machine more efficiently than anyone else—then translate those savings into consistently low prices. The result is a competitive advantage that’s hard to copy: Walmart can operate on thin margins because its scale, supply chain discipline, and data-driven execution help it protect profitability through volume.

In this post, we’ll break down the core pillars behind Walmart’s approach, how they connect to profit optimization, and what pressures (and tradeoffs) come with a model designed around cost control.

Quick summary: Walmart keeps costs low through operational efficiency, scale purchasing power, a disciplined supply chain (including cross-docking), and technology-driven planning—supporting “Everyday Low Prices” while protecting profitability through high volume and tight execution.

Table of Contents

- Introduction to Walmart

- What “Cost Leadership” Means in Retail

- Key Elements of Walmart’s Strategy

- Impact on Profit Optimization

- Challenges and Criticisms

- Future Outlook

- FAQs

- Useful Links

- Conclusion

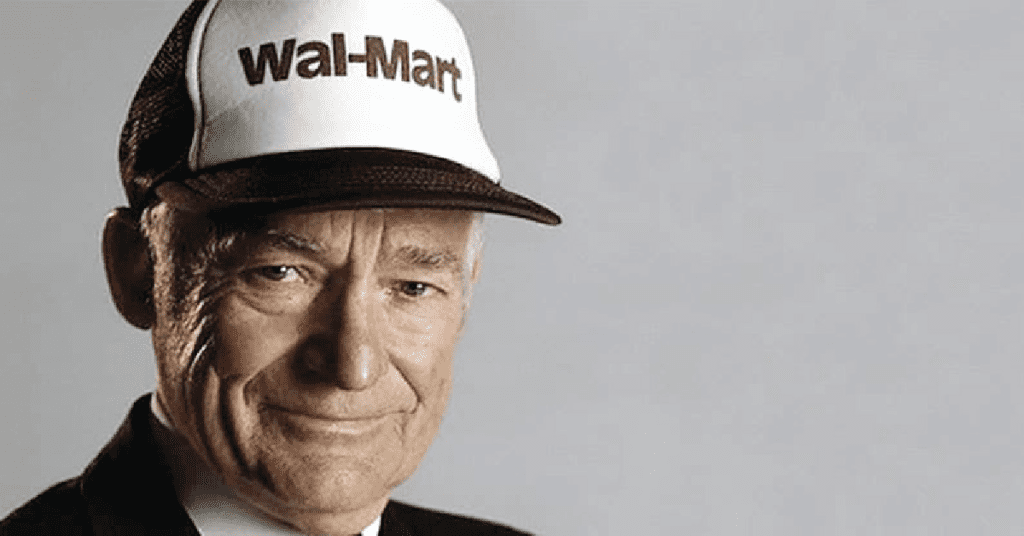

Introduction to Walmart

Founded in 1962 by Sam Walton, Walmart has grown into the world’s largest retailer by revenue. Its success is strongly tied to a long-term commitment to cost leadership—often summarized as Everyday Low Prices (EDLP)—supported by operational rigor and a supply chain designed to minimize waste.

Cost leadership isn’t just “charging less.” It’s a system: the entire operating model is built to reduce friction and expense, so the company can sustainably price aggressively while still generating profit.

What “Cost Leadership” Means in Retail

In retail, cost leadership means winning by being the lowest-cost operator in the market. It often shows up as:

- Lower prices (or fewer promotions because prices are already competitive)

- Higher turnover (inventory moves faster)

- Consistent customer value perception

- Stronger resilience in price wars

Walmart’s version of cost leadership is especially powerful because it combines scale with process discipline—not just one or the other.

Key Elements of Walmart’s Strategy

1) Operational Efficiency

Walmart treats efficiency as a daily practice, not a one-time initiative. That shows up in:

- Lean operations: reducing waste, standardizing processes, and simplifying execution in stores and distribution.

- Store layout optimization: layouts built for fast replenishment and predictable customer flow, reducing labor friction.

- Energy management: investments in efficiency across stores and facilities to reduce long-term operating costs.

- Continuous improvement culture: small savings multiplied across thousands of locations become meaningful.

Why it matters: In high-volume retail, small cost reductions per unit can translate into meaningful margin protection.

2) Economies of Scale

Scale isn’t only about buying power—it’s also about spreading fixed costs and reusing capabilities across a massive footprint.

- Bulk purchasing: massive volumes help secure lower unit costs and better supplier terms.

- Shared resources: technology, logistics, and best practices can be deployed across thousands of stores.

- Private label brands: owned brands can support stronger margins while keeping shelf prices low.

- Global presence: scale supports learning transfer and purchasing leverage (with local adaptation).

Why it matters: Scale lets Walmart compete on price while still funding logistics, tech, and store operations.

3) Supply Chain Optimization

Walmart’s supply chain is a core competitive asset. It’s designed to reduce waste, speed up replenishment, and keep product flowing efficiently.

- Cross-docking: moving goods from inbound shipments directly to outbound trucks, minimizing storage time and cost.

- Vendor Managed Inventory (VMI): suppliers help manage replenishment to reduce inefficiencies.

- Tighter replenishment: better planning reduces carrying costs and improves availability.

- Network strategy: distribution centers placed to reduce transport costs and improve service levels.

Why it matters: Better supply chains don’t just cut costs—they reduce stockouts, overstocks, markdowns, spoilage, and emergency shipping.

4) Technology Integration

Technology helps Walmart turn scale into precision—especially in forecasting, inventory productivity, and omnichannel execution.

- Data analytics: improving demand forecasting, pricing decisions, and assortment planning.

- Inventory visibility: better tracking reduces shrink and manual work.

- Automation in replenishment: smarter ordering helps reduce stockouts and excess inventory.

- Omnichannel operations: using stores as fulfillment nodes for pickup, delivery, and returns.

Why it matters: Modern cost leadership is as much about decision accuracy and speed as it is about physical logistics.

5) Supplier Negotiation

Supplier strategy is a major lever in Walmart’s cost structure—especially at its scale.

- Volume concentration: consolidating purchases can increase leverage and standardize execution.

- Long-term arrangements: stability can reduce costs when paired with clear volume expectations.

- Process transparency: pushing for upstream efficiencies across production and delivery.

Why it matters: Walmart’s ability to sustain EDLP depends on both internal efficiency and upstream cost discipline.

6) Workforce & Scheduling

Labor is one of retail’s biggest cost centers. Walmart’s approach typically focuses on aligning staffing to demand and reducing operational “chaos.”

- Demand-based scheduling: matching staffing levels to traffic patterns.

- Training & standardization: improving productivity and reducing costly turnover.

- Operational consistency: fewer errors, faster replenishment, and smoother store execution.

Why it matters: Better labor planning reduces hidden margin leaks like misplaced inventory, slow replenishment, and poor on-shelf availability.

7) Location Strategy

Store placement and real estate decisions can support cost leadership by improving unit economics and lowering the cost to serve customers.

- Rural/suburban density: strong coverage in areas with fewer direct competitors.

- Distribution proximity: lower transport costs and faster replenishment.

- Long-term real estate planning: securing locations that support network effects and growth.

Why it matters: Location impacts both revenue potential and operational cost—especially logistics and labor efficiency.

Impact on Profit Optimization

Walmart’s cost leadership model supports profit optimization through compounding effects across the business:

- Lower unit costs → pricing flexibility: Walmart can compete aggressively without destroying margins.

- High volume → profit through turnover: when margins are thin, inventory velocity matters.

- Fewer markdowns → higher-quality gross margin: better planning reduces discounting.

- Better cash efficiency: faster turns can improve cash flow dynamics.

- Fewer operational “leaks”: reduced shrink, waste, stockouts, and emergency shipping protects margin.

In short: Walmart doesn’t rely on a single cost advantage—it runs an interconnected system that keeps expenses low and performance consistent at scale.

Challenges and Criticisms

Cost leadership at Walmart’s scale comes with tradeoffs and scrutiny. Common challenges include:

- Supplier pressure: aggressive pricing expectations can strain suppliers and raise sourcing concerns.

- Labor and scheduling debates: cost control can create tension around wages, hours, and employee experience.

- Community impact: large-format retail can reshape local retail ecosystems.

- Reputation risk: “low price” positioning can conflict with premium perceptions and sustainability messaging.

- Macro volatility: inflation, tariffs, fuel costs, and supply disruptions can pressure EDLP models.

Future Outlook

Walmart’s cost leadership edge is likely to depend on how well it evolves in three big areas:

- Omnichannel efficiency: turning stores into high-performing fulfillment nodes without bloating cost-to-serve.

- Automation and AI: improving forecasting, replenishment, and labor planning while reducing waste.

- Sustainability economics: reducing energy usage and supply chain waste in ways that also improve operating costs.

The future version of cost leadership will be less about simply “buying cheaper” and more about operating smarter at scale.

FAQs

How does Walmart keep prices low?

Walmart keeps prices low by combining operational efficiency, massive purchasing scale, disciplined supply chain execution (including cross-docking), and technology-driven planning that reduces waste and improves inventory productivity.

What is Walmart’s main competitive advantage?

Its cost leadership operating system: scale + logistics + process discipline. This allows Walmart to price competitively while protecting profitability through volume and consistent execution.

How does the supply chain support cost leadership?

By reducing storage time, transport waste, stockouts, and markdowns. Techniques like cross-docking, optimized distribution placement, and tighter replenishment help keep the cost per unit low while improving availability.

How does Walmart use technology to reduce costs?

Walmart uses analytics and automation to forecast demand, improve replenishment accuracy, reduce excess inventory, and support omnichannel fulfillment—so the business runs with less waste and fewer operational “leaks.”

What are the downsides of cost leadership?

Cost leadership can create pressure on suppliers, fuel labor-related criticism, and increase reputational risk. It can also be tested by macro shocks like inflation, tariffs, and supply disruptions.

Useful Links

Conclusion

Walmart’s cost leadership strategy remains a cornerstone of its retail dominance. By relentlessly optimizing operations and leveraging scale, Walmart can sustain competitive pricing while protecting profitability through high inventory turnover and disciplined execution.

As retail evolves, the next phase of cost leadership will increasingly depend on omnichannel efficiency, automation, and smarter planning—so Walmart can keep costs low without compromising resilience, trust, and long-term brand strength.